Skip to main content Lecture 2 Behavioral Finance | October 9th, 2023

Behavioral Economics

- A number of economic frameworks assume that humans evaluate financial decisions consistently and rationally

-

Heuristics

- Humans make a vast majority of their decisions using mental shortcuts

-

Framing

- Humans use anecdotes & stereotypes to understand & respond to events

-

Market Inefficiencies

- Mispricing or non-rational decision making

Anchoring

- People estimate answers to new & novel problems with a bias towards reference points

- Common examples

- Price you bought a stock at

- High point for a stock

Mental Accounting

- Money is fungible, but people put it into separate “mental accounts”

- Also known as “bucketing”

- Example:

- Lost Movie Tickets

- Lose 40 dollars or two tickets in advance (no one wants to buy movie tickets twice)

- “Found Money” → parents’ money

- Real world problems: Vacation Fund & Credit Card Debt

Confirmation & Hindsight Bias

- Very different biases, but often conflated with each other.

-

Confirmation Bias

- We selectively seek information that supports pre-existing theories, and we ignore/dispute information that challenges or disproves them

-

Hindsight Bias

- We overestimate our ability to predict the future based on the “obviousness” of the past

- Confirmation of the two is particularly bad

Gambler’s Fallacy

- We see patterns in independent, random chains of events

- We believe that, based on a series of previous events, an outcome is more likely than odds actually suggest

- Example: Dinner Party & Coin Flips

- Real odds might be 51/49, but we tend to jump to 80/20

- Likely cause: the rarity of “independent events” in day-to-day experience

Herd Behavior

- Tendency to mimic the actions of the larger group

- Building Psych Experiment

- Empty Supermarket

- Crowd psychology may be a contributor to bubbles

- Bucking the crowd creates stress & fatigue, it gets harder, not easier.

- Easier to be “wrong with everyone” than “right and alone”

Overconfidence

-

Dunning-Kruger Effect. The more poorly you perform, the more you over-estimate your performance

- Capability in one domain can lead to overconfidence in others

- Humility is a virtue

Recency & Availability Bias

- Recency Bias

- We overweight recent events in our decision making

- Example: 2008 Financial Crisis & Celebrity Illness

- Availability Bias

- We assume that the data we have been provided is representation of the entire data set

- Studies show checking stock prices daily leads to more training & worse results on average

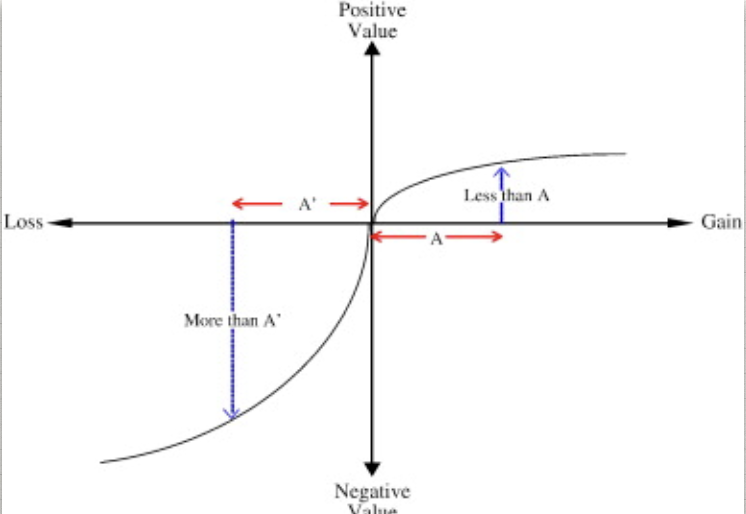

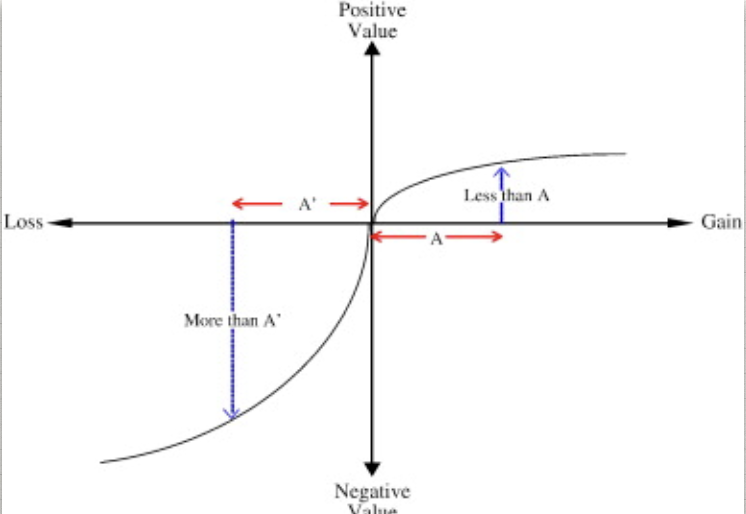

- We hate losses more than we love winning

- We even hate being responsible for losses → it’s OKAY to not be rational